General Process

Financing

FAQS

General Process

Financials

BENEFITS OF PHYSCIAIN LOANS

Here is a quick hitter summary of what are the main perks of choosing a physician loan vs. a traditional conventional mortgage

If you want to learn more about in what situations you may choose to do an ARM vs a Fixed rate mortgage check out our "A Deep Dive on ARMS" section.

NO PRIVATE MORTGAGE INSURANCE

This is a big benefit to those with less than 20% down. Private Mortgage Insurance (PMI) is a monthly insurance premium you would pay like car insurance to the bank since you a at higher risk of defaulting on your loan sine you have less than 20% down.

Every bank out there will claim they have a "NO PMI SPECIAL DOCTOR LOAN PROGRAM" for you.

This is simply not true. If it is a conforming conventional mortgage- the literally cannot give you a loan without PMI.

The way they get around this is by charging all your monthly mortgage insurance payments up front in your closing costs (a few thousand dollars) and then they simply increase the interest rate 0.25%-0.5% higher than it could have been if you have 20% down to cover the "cost" and say "Look we have a no PMI program!" On the back end as a mortgage loan officer we call this "Up front mortgage insurance" or "Lender Paid" mortgage insurance. It is super sneaky to say you don't have mortgage insurance when in all reality you do. It is just wrapped into the loan. REAL physician loans don't have ANY mortgage insurance at all- monthly OR lender paid. Meaning you have a lower interest rate.

Click HERE to learn how to tell a "true" physician loan from the "fake" ones.

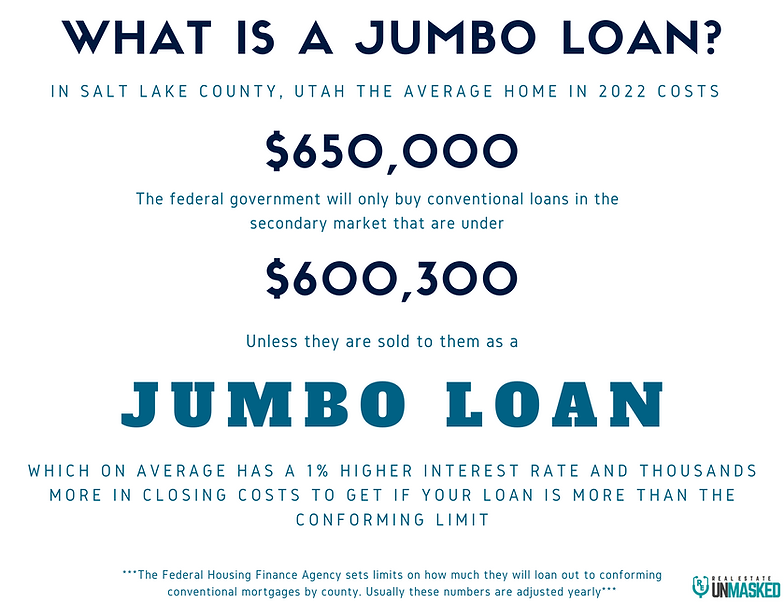

AVOIDS JUMBO TERRIORY

A jumbo loan is a conforming conventional mortgage with "penalties" for going above whatever your county loan limit is. These change yearly and are published in an excel sheet by Fannie Mae on their website. You can easily find what your county limit is by googling it or asking a loan officer.

The perk of physician loans?

Because they are "non-conforming" meaning the bank directly lends its own money and doesn't have to play by the government set rules, they allow you to borrow significantly more than the government would give you, and they don't increase your rate or closing costs because of it. Example: In Utah if someone wants to buy a home with 20% down, with a loan of $700,000

-

A conforming conventional loan even with 20% may be 7% since it is a jumbo loan.

-

A physician loan may be able to get them a 5.5% rate for the same cost with 20% down.

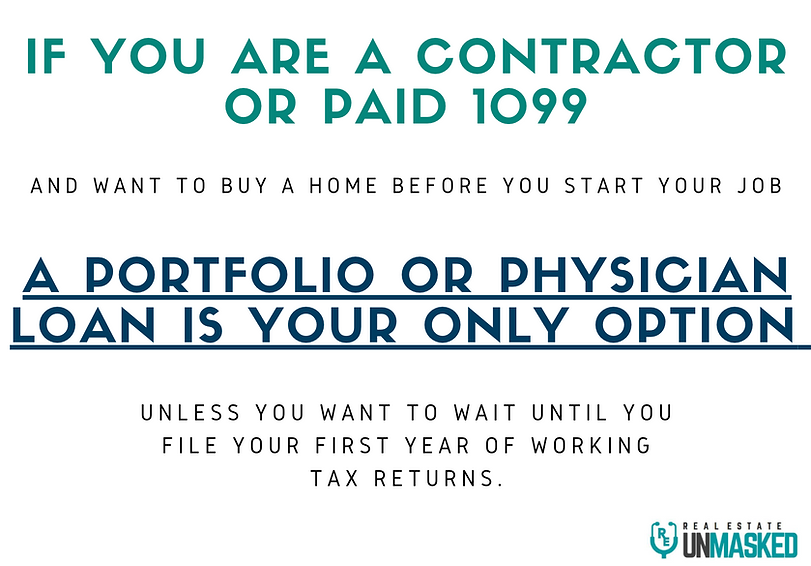

MORE LEINIENT ON SOLE-PROPRIETORS

Anyone compensated with a W2 contract can purchase a home up to 90 days before the start date of a job as long as certain stipulations are met. But if you are 1099- Fannie Mae and Freddie Mac conforming standards will not give a loan to someone without at least a 1 year history of income reported on your tax returns. Most attendings start their first job in July. Which only gives 1/2 year worth of income. So functionally to use your full income to qualify to purchase a home you have to wait 1.5 years out of graduation if you use traditional conventional financing. Physician loans can get around this if you are paid 1099 and have a "contract guarantee" that states a salary, an hourly rate, or a base guarantee.