General Process

Financing

FAQS

General Process

Financials

WHAT IS

TITLE INSURANCE?

Homes carry Title just like a car carries title. Unlike car title, home title is not a physical document declaring ownership. That is the Deed in homeownership. So if it title is not simply just a piece of paper that proves you own the home, what is it?

Title to a home includes all the legal rights of homeownership. They include:

-

Lease

-

Sell

-

Use

-

Encumber

-

Exclude

-

Enjoy

-

Devise by will

Title needs to be clean and free of any liens and encumbrances for a bank to allow you to put a mortgage lien on it. Lets go into the details of what a title company does for you when you buy a home, what is title insurance, and other general title questions

The cost: If you estimate the cost of all the title company fees (Title insurance policy, Closing fee, abstract fee, recording fee ect.) to be about 1% of your loan amount, that is in the ballpark. Title company fees are pretty similar from company to company since their rates are public like gas stations, so shopping title companies is not nearly as important as shopping lenders.

-

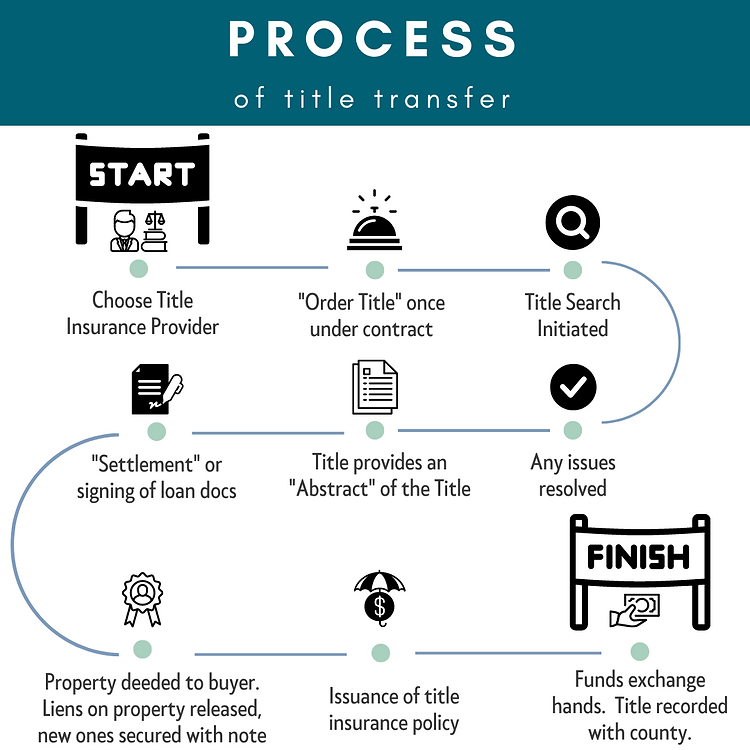

Find a title insurance provider or "Title Company"

-

Title companies are managed by attorneys. They make sure all the legal documentation is provided according to the law to lawfully transfer a property from one party to another. They usually have title agents who they train to do all the run of the mill tasks that don't require a license to practice law. You will interface with the title agent for the most part and 90% of home buyer and sellers don't even know an attorney is involved or talk to them at all.

-

A home title can be "held" in many different ways conveying certain rights and percentages of ownership. Some examples of these are: joint tenants, tenants in common, sole ownership, tenants by entirety, community property, and in trust to name a few. Talk to a title company attorney to see which way would be most advantageous for your situation when you first find a home so the correct documentation can be submitted to the bank.

-

-

Once you choose the company, they will order the title to be searched and documents gathered to prove to the lender the title is clean. They will also make sure you are a qualified buyer and do not have any judgements outstanding against you that would make it not possible to purchase a home without resolving the judgment. On the seller side they work to clear any title defects (if any) so the lender will allow you to purchase a home. They will also provide you with any other publicly recorded documents like subdivision HOA rules or Covenants, codes, and restriction documents. Liens follow homes, not people. So if there is a construction lien placed on a home where the old owner never paid the roofing contractor who re-roofed the home, if you purchase the home with the lien you are the one responsible to pay it, even though it was not "your lien" technically. Most banks will not allow homes to be bought with liens on them.

-

Title prepares and sends you an "abstract" or chain of title, showing the continuous ownership of the home and any liens that have ever been on the home as to assure you are the only one who can claim legal title. This is where Title insurance comes in. If for some reason there is a break in the chain of title, meaning someone deeded the property to the another person, but really did not have the right to do so, and they came and tried to claim your home, title insurance covers all the costs and legal fees that it would take to fight that claim in court. Title insurance is required by banks, and is included in your loan closing costs.

-

The loan gets final approval- and then you sign all your loan documents typically at the title company as title agents are all notaries. They help explain your documents and get them back to the lender.

-

Once the loan documents are signed by both the buyer and seller, the title companies coordinate and start sending each other paperwork. The seller title company provides the buyer company with proof of the deed being signed and given to the buyer. The buyer's title company makes sure all parties involved get paid and that the numbers all balance and are correct. If the seller had a mortgage, that gets paid off and released, and the new mortgage for the buyer get recorded as a lien with the new deed at the country.

-

Title insurance policy goes into effect after closing.

-

As soon as all parties have been paid and funds are exchanged and both title companies agree everything is in good standing, the buyer title company sends the required documents to "record" the deed publicly at the county recorders office. Once it is recorded and funded, that is when the official transfer of ownership has been completed and is official.