General Process

Financing

FAQS

General Process

Financials

COSTS OF BUYING

A HOME

I want to buy a home, but don't know if I can afford it. What are all the out of pocket costs I need when buying a home?

UP FRONT COSTS

1. Down Payment : A down payment is not required for a physician loan. If physician loan options are not available to you, the minimum down payment one would need is 3% down for a conventional loan and 3.5% for an FHA loan. There are grants and government programs state to state that can help assist you with a down payment if a physician loan is not an option. A local real estate market specialist will know about these programs and options in your area. If you want to learn more about the 0% down program click HERE. If you want to learn more about the non-physician loan mortgage options click HERE.

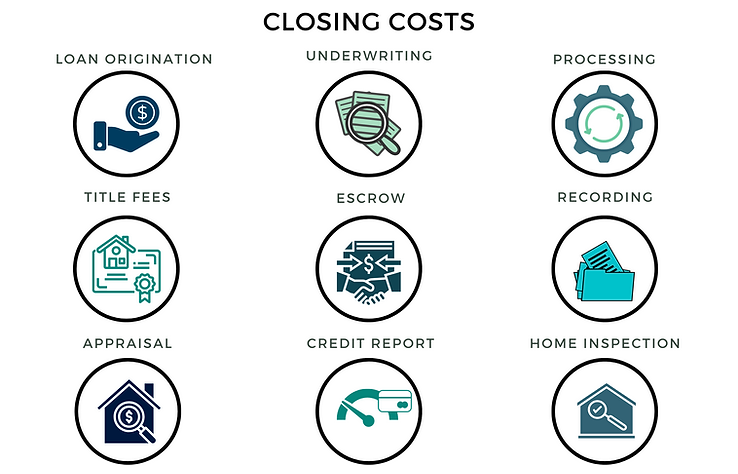

2. Mortgage Loan closing costs

Mortgage loan closing costs can differ greatly depending on which bank you choose to work with. It can be as little as $0 out of your pocket to tens of thousands of dollars. We go into depth on mortgage loan closing costs and how to shop for a mortgage with the overall best terms and costs in depth in our "How to shop for a Mortgage" class.

For the purpose of budgeting for an average loan, we will give you a sample of what we typically see for mortgage costs and what each fee is for. We assume a $400,000 mortgage to help illustrate numbers. These estimates go up as the loan amount (purchase price-down payment) increases and decrease as the loan amount goes down. This is because closing costs are a percentage of your loan amount.

You can ask the seller to help cover some of these loan closings costs in a purchase contract if the market is not overly competitive to decrease your up-front out of pocket cost. If doing a 0% down physician loan make sure the lender allows for seller concessions as some companies won't allow a seller to "gift" you more than your down payment. In the case of 0% down that could mean the seller agreed to 3% closing costs in your purchase contract with your realtor, but the bank will not allow it, leading to frustration and renegotiation.

-

Origination fee (paying the loan officer) ~$1000 for physician loans. Varies greatly with traditional conforming conventional loans. On a client we helped here in Utah back in 2018, there once was a $12,000 different in out-of-pocket costs and the payment was going to be $300 more a month. Just an illustration of the importance of shopping around.

-

Processing & Underwriting (bank processing fees) ~$1,500

-

Title Fees (assures clean title to home and takes care of monies transfer)~ 0.75% of the purchase price

-

Escrow (a forced savings account your lender sets up to pay your monthly homeowner insurance and county taxes for you)- Highly dependent on your county property taxes. In Texas it is astronomically higher than in Utah because Property taxes are higher. Also homeowners insurance varies greatly because natural disaster hazards in some areas make this payment much more than others. Smart Asset has a calculator that can more accurately estimate the taxes and insurance for an area, but it is best to reach out to a loan officer and Realtor to get these numbers for your area specifically. If you estimate 1% of the purchase price you probably would be in the ballpark, but could be a gross over or underestimate. ~$3000

-

Recording- Paying the government to publicly record the deed when you buy the home ~$100

-

Appraisal- Paying a third party to value the home. A bank will not loan more than what a home appraises for. ~$500

-

Credit Report ~$100

3. Due diligence items Home inspections and due diligence items- Technically not wrapped into your loan. You will have to pay these out of your pocket up front if you want theses. Some examples of inspections you may want to do are: General home inspection, mold, meth, radon, termites, structural, plumbing, electrical, perk tests, septic testing, survey for zoning ect. The sky is the limit on costs on this one. 90% of our clients spend less than $1000 on their inspections. We go into more detail about the home inspection process HERE.

At the end of the day If you budgeted in the middle (~2% or $8000 on a $400,000 home) you should have no issue finding a mortgage and being able to cover all your costs. And if you over budget you can "buy down" your rate or save it for your long-term mortgage costs.

LONG TERM COSTS

-

Maintenance Costs- Rule of thumb is that you should have 1% of the value of your home set aside for maintenance costs year to year. The big hitter costs to repairing in a home are the furnace, AC, water heater, roof, sewer and foundation issues. These are types of issues that usually are immediate and need to be fixed right away.

-

Many lenders will require that you have 3-6 months of reserves sitting in your bank account on top of your closings costs and down payment to qualify for a loan. If you put more money down or have already started your new job, the more lenient they are on this requirement.

-

Mortgage Payment

-

Principle, homeowners insurance, county property taxes, interest (PITI)

-

We talked about your "escrow" payment in closing costs above. You make one payment to your bank monthly and they will pay your taxes and insurance for you unless you opt for an "escrow holdback" agreement with your lender. If the costs increases, they communicate with your insurance company and the county clerk for your tax bill and adjust your payment yearly to account for this change. Your mortgage payment will only change for those reasons if you have a fixed rate mortgage. Even after you pay off your mortgage you will have to pay taxes and (should) continue a home insurance policy. With an adjustable rate mortgage (ARM) your payment can increase once you get out of the "fixed" period. If you want to learn more about adjustable-rate mortgages and when they could be a good idea, click HERE.

-

-

-

Home Owner Association Fees (HOA).

-

If you live in a condo or a townhome, this fee will be more. Usually it includes (some) utilities but not all. If you move into a home with an HOA and you do not pay the monthly fees, they could have the right to fine you and place a lien on your home, so it is important to understand your HOA and their rules and regulations before you purchase a property. It is also important to know that the HOA board can vote to increase the HOA dues at any point, or do a "special assessment" cost that you are obligated to pay or they can place a lien on your home, even if you don't personally agree to the HOA changes. This is extremely important when you are thinking about renting a home because some HOA's have rules that rentals are not allowed. The document you will want to read to find out what the HOA monthly fees and rules are is called the Covenants, Codes, and Restrictions documents recorded with the community (CC&Rs). If a community is an FHA approved townhome or condo, they will have a minimum requirement that at least 50% of the units are owner occupied. If for any reason it ever goes above that threshold, they will not allow you to rent your property until that threshold decreases, even if the HOA "allows" rentals.

-