General Process

Financing

FAQS

General Process

Financials

SHOULD I

RENT

OR BUY?

Should we rent or buy during our medical training? How many years do we need to be in one place to make purchasing a home worth it? What are the pros and cons of renting vs buying? How do I know I'm ready to purchase a home?

Across all specialties in healthcare salaries have not kept pace with inflation in the US. With increasing student loan burden making the correct financial decision between renting and buying is crucial. The decision is highly affected by what stage of training you are in, where you live, and how long you plan to be in one place at a time.

The question to rent or buy is a highly debated topic among healthcare financial experts. We are not here to tell you which one is best for you, but to provide resources, tools, data, and experience to help you make a more informed decision for your specific situation.

My wife and I rented during all of medical school and our early years of training. We eventually purchased a home a few years into residency. As we think back on reasons we decided to buy vs rent, it came down to three things:

-

Functional needs: Elements like Commute, home size, pets allowed, schools ect.

-

Freedom: The ability to customize our home vs the freedom of not having to worry about home maintenance.

-

Finances: What were our up front, ongoing, and long-term costs of buying, vs renting.

For most people it is pretty easy to figure out the functional and freedom piece of where you want to live. If those two options are satisfied, and the option to purchase a home is still on the table, usually the final decision-making factor to buy or rent does come down to the finances.

Generally in training we recommend finding the cheapest option that will meet your baseline functional and freedom needs. Then do a financial analysis for these options between renting and buying.

Ben Felix, a Canadian portfolio manager, came up with a quick and dirty approach to this calculation called the 5% rule. Basically you simply multiply the value of the home by 5%, then divide that number by 12 to get your breakeven point. If the monthly rent on a comparable home is below the breakeven point, it makes financial sense to rent. If the monthly rent is higher than the breakeven point, it makes financial sense to buy.

While this is a good starting point we recommend doing a more robust analysis particularly during training where we tend to move a number of times before settling into our careers. Below are the tools we have used with clients.

-

Nytimes.com: https://www.nytimes.com/interactive/2014/upshot/buy-rent-calculator.html

-

SmartAsset.com: https://smartasset.com/mortgage/rent-vs-buy#8N4z4sEWPN

-

NerdWallet Calculator: https://www.nerdwallet.com/mortgages/rent-vs-buy-calculator

-

Calculator.net: https://www.calculator.net/rent-vs-buy-calculator.html

-

Realtor.com: https://www.realtor.com/mortgage/tools/rent-or-buy-calculator/

The New York times version has a slider at the top where you can adjust the number of years you plan to be in a location, which is why we have it listed as number 1. Below is a list of the most significant financial factors in renting vs buying. Looking up estimates of what these are and putting them into the above calculators can give you a much better idea of whether or not purchasing a home is in your best financial interest.

-

City you will live in

-

Rent

-

Starting Rental Fee

-

Predicted Rent Appreciation/yr

-

Renters Insurance/mo

-

Predicted renters insurance increase

-

Security Deposit

-

-

Home Purchase

-

Home Price

-

Downpayment

-

Interest rate

-

Closing Cost

-

Property Tax/yr

-

Property Tax increase/yr

-

Home Insurance/yr

-

Cost/Insurance Increase/yr

-

HOA Fee

-

Maintenance Cost/yr (%)

-

Home Appreciation/yr

-

Selling closing costs

-

Finally there are some factors which may push the envelope one way or another in renting vs buying. Perhaps you are willing to spend a little extra money to have a place of your own without a landlord to be accountable to. Or maybe you would absolutely dread the idea of having to pay for all the maintenance costs of the home during training. Each of the Freedom and Functional factors play a role into the decision. Finally you may be interested in becoming a landlord and developing the property as an asset after you are done living there which may tilt you toward purchasing even if it doesn't pay off in the short term.

Renting or buying both come with risks. Below we address some of the main financial and risk profile concerns healthcare professionals encounter when trying to decided to rent or buy.

RENTING CONCERNS

1. I am concerned about rental rates increasing when my lease is up every year, what can I expect typically?

Historically average rents have increased about 4.17% year to year, which follows close to inflation. But the years of 2018-2022 we have seen more of an anomaly. According to a study done by Redfin and reported in the Guardian in the USA over the last few years on average we have seen a rental increase of 14% rental increases year to year.

.png)

14% has been average the last few years but depending on your area rental increases could be better or worse. At the beginning of 2019 we helped an orthopedic resident purchase a home where most the co-residents rented. Within the next year rents increased 22% two years in a row. Unfortunately as a result of that increase, most his resident cohort had to downsize, or move to a place further away from the hospital to afford rent. Knowing that the last 5 years has seen more volatile shifts in market rents can help budget, plan for, and be prepared for those increases if you choose to rent.

Many landlords want a tenant who will pay rent, stay long term, and take care of the property, and they usually will give you a slightly better rate if you sign a lease agreement of a year or more. They will not know what kind of tenant you will be when you first sign a lease with them, it will take at least 6 months to develop a relationship of trust with a landlord. Try to negotiate in your contract a trial clause that states you sign a year-long lease with a 6 month trial period. If at 6-months both you and the landlord want to continue renting past a year, you agree to a XX year rental rate where rates will not increase, but you have the option to leave if you give 1 months notice. Many landlords are happy to do this if they don't have the hassle and cost of finding a new renter every year.

2. I feel like I am just flushing money down the drain every month I pay rent.

Compared to paying rent vs a mortgage, you may be surprised that the money that "disappears" from renting may not be as much as you think. According to CNBC rental prices for single family homes swelled during the first half of 2022, hitting a national average of $2,495 a month. Historically average rents have increased about 4.17% year to year. Whereas the average estimated monthly mortgage payment for a purchase is $2959 a month in 2022. Since a mortgage is amortized, most the initial payments on the homes are not being put towards equity. On your very first mortgage payment amortized over 30 years only about 10-15% of it will go to the principal balance of your home. That percentage will gradually increase every payment you make, but it will not even get to 50/50 split until 180 months in. Meaning the majority of your payment is "lost" just like rent would be. When you factor in the cost to sell, and maintenance costs, purchasing a home may end up costing more out of pocket than renting depending on how many years you can stay in a home and what the current market trends are dictating in regard to home appreciation or depreciation values.

BUYING CONCERNS

1. I don't want to buy at the height of the market, then be forced to sell and take a loss if I am not here very long.

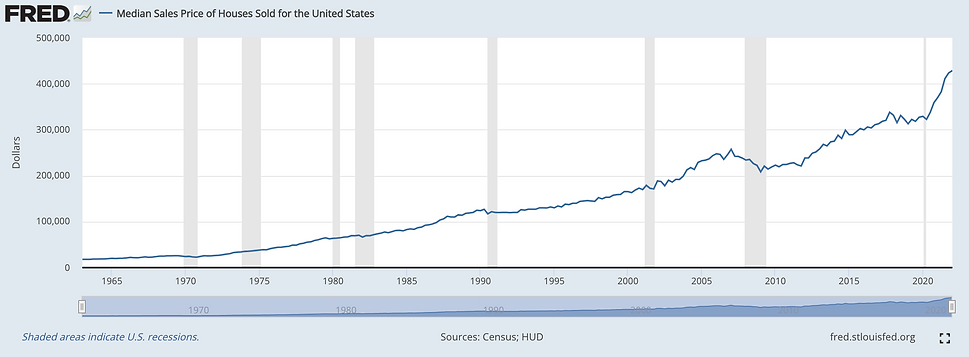

The Graph above is the average sales price of a home in the USA for the last 50 years. Any area that is shaded indicates a US recession. Overall, the housing market has been able to recover from last eight economic recessions, the most severe being the 2007 housing crisis- which took until Q3 of 2013 to reach pre-recession home values- about six years. Looking at this graphic, one would say the earlier one invested in real estate, the greater ones return. Even those who bought at the height of the 2007 housing crash are seeing over $200,000 of appreciation 15 years later.

Historically speaking, anytime a person has bought a home in the last 50 years, there were only 8 times when they were not purchasing a home at the "height" of their current market. One could try to time buying a home based off a recession but looking at a home as a longer term investment, on average the longer one waits to purchase a home, the more they will pay for it later. The worst of all the economic recessions that effected the housing market lasted 6 years. This time frame is longer than most healthcare professionals are guaranteed to be able to stay, so purchasing a home will need to be a calculated risk if someone is not willing to stay in it for at least 6 years. If you are willing to stay in a home either by living in it yourself, or renting it until a recession recovers, the risk of buying goes down.

2. Can we even qualify to buy a home or afford the payment? We have no liquid cash available for a down payment, mountains of debt, and no source of income until we are done with school -and even then it is minimal.

This is where we would recommend you go to our section of Physician Loans if this is your situation. Many healthcare professionals in this situation purchase homes. Read about the different ways you could purchase a home in this section and decide if it is right for you.

3. We are just coming out of COVID, and I have heard mortgage interest rates are high. I don't want to purchase and lock in a home at a higher interest rate.

The interest rates in 2022 have ranged from the mid 4% to the low 6% range. Coming out of the COVID pandemic where rates at the lowest were 2.65%, was major sticker shock for buyers along with the increased home prices. It is important to keep a longer-term perspective when comparing what a "good" rate is. Prior to 2008 a rate below 5% had never even been seen. Over the last 50 years anything under 8% was a deal. Although many buyers in 2022 were concerned about a rate in the 5-6% range, a rate less than 6% is still quite incredible historically speaking.

When considering if it is the right time to buy a home, we would not let the current market rate deter you from purchasing a home. What we absolutely would do is make sure you get a payment you are easily comfortable with whatever the current market rate is. Do not sign up for a mortgage payment you cannot afford hoping rates will drop.

With Mortgage rates, you can have the opportunity to "Re-Finance" the mortgage if the current market rate drops below what you locked in your current mortgage rate for. Over 35% of homeowners in the United States refinanced their homes in 2020-21 when rates were averaging in the 2% range. Typically, only 4% of homeowners refinance their homes in a year, so it usually is not a very common occurrence. You will hear many in the mortgage industry say "Marry the home price, date the rate". What they mean by this is they know the data in graph 1: home prices steadily increase. When you purchase a home, you lock in that price once. But a rate can be changed, but there is no guarantee they get better with time.

We disagree with this phraseology "Marry the home price, date the rate" and would change it to "Marry your home payment, date your rate."

4. How can I mitigate my financial risk in purchasing a home if I decide to buy?

-

Plan to personally live in the home for 5-6 years.

-

Any resident who bought during the early 2000's would echo this. When you talk to anyone from that era, they all recommend not buying a home since they lived through the 2008 crisis and saw their friends burned.

-

In the 2016-2020 era we had one medical student pay off all their medical school debt from the proceeds of a condo they bought 1 year into medical school, another fellow made 90,000 in one year from buying and selling. This rule doesn't mean absolutely don't buy- just means there are higher risks if you plan on staying less than 5 years

-

-

Be willing to rent the home if needed.

-

If being a landlord is in your future and you intend to stay in the area you buy the home in long term- it is almost a no brainer to buy. Purchasing a personal residence and converting it over to a rental has many benefits- including:

-

-

Lower out of pocket up-front investment. Using OPM (other people's money) to leverage your investments. Physician loans can get into a home for 0% down on a 30-year conforming conventional mortgage. That same mortgage for an investor takes a minimum of 15% down if buying it without living it it first.

-

Lower interest rates. If you convert a personal residence to an investment- you still get to get to keep the benefit of the lower rate. Personal residence mortgage rates vs investment are in the ballpark of 05.%-0.75% lower rate just because of the ownership type.

If you read all this and decide renting is for you, we are working to provide a list of aggregate websites that have rentals passed down from medical trainees in your specific area. Check back soon for more info. If you want to consider buying and need more information, continue reading below.